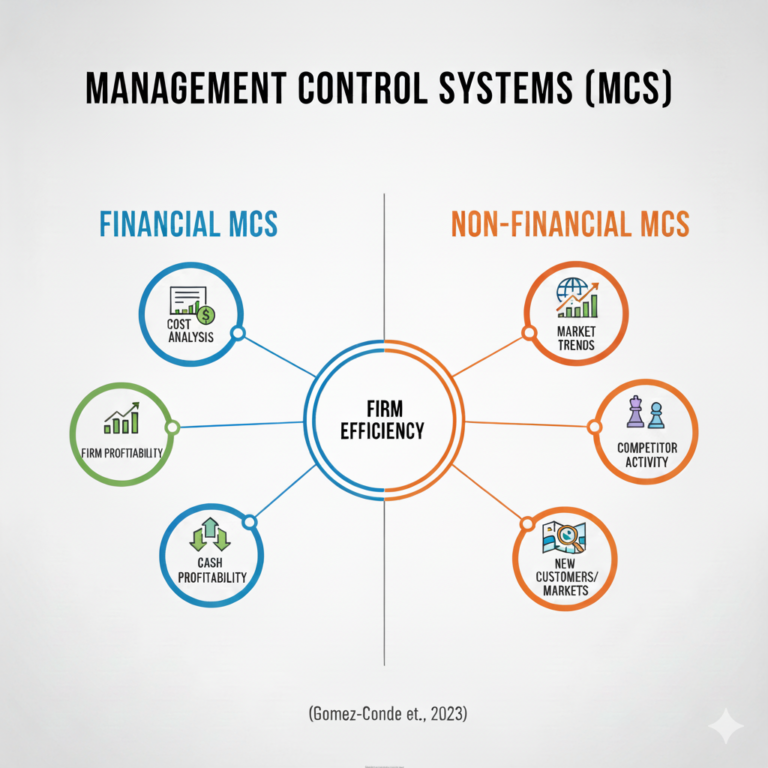

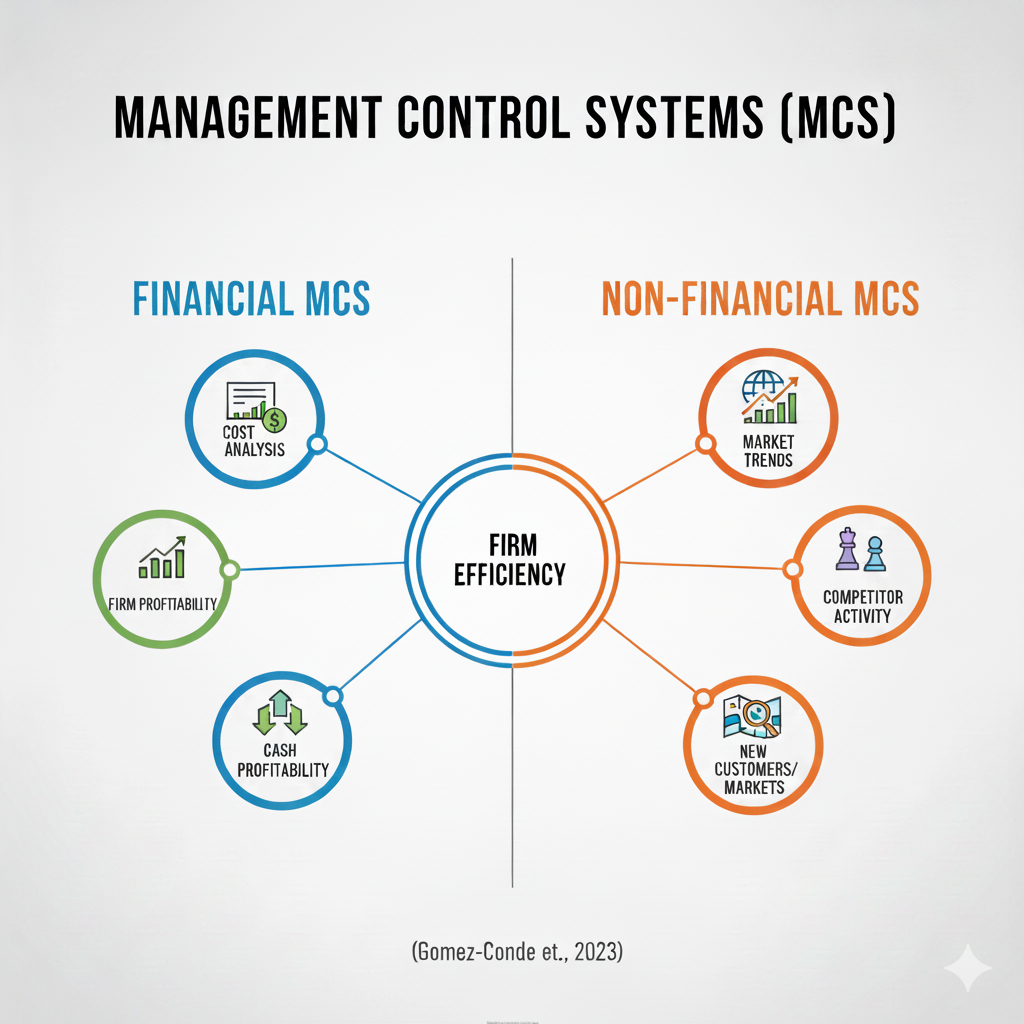

Financial management control systems (financial MCS)

This is a set of formal procedures and routines that focus on providing tactical information

necessary for the day-to-day management of a company’s operations. In startups, they act as a “guardian of stability,” helping entrepreneurs answer the key question: “Are we able to generate cash and profits by delivering our products or

services to the market?”

They include tools such as:

- financial planning – preparing operating budgets,

- financial assessment – analyzing actual results against budget assumptions,

- cost accounting – accurately determining the expenses incurred by a startup,

- cash flow control – monitoring indicators such as burn rate (the rate at which money is spent) and runway (the time a company can operate before it runs out of funds).

Their use is negatively correlated with the level of debt. These tools promote a so-called “managerial mindset,” which focuses on operational efficiency and maintaining control over finances. Entrepreneurs using financial MCS become more aware of financial risk, which prompts them to make cautious decisions and avoid excessive debt that could threaten the stability of the company.

In startups operating in incubators, the implementation of these systems is often enforced or supported by the institution itself (the so-called “incubator effect”).

Managerial mindset as the basis for company stability

A managerial mindset is crucial for the survival and stability of a startup, as it provides a necessary counterbalance to the risks associated with rapid growth and scaling of the business. Entrepreneurs with a managerial mindset tend to avoid risky positions. Their approach is often described as “playing it safe,” which manifests itself in promoting conservative decisions and prioritizing financial security over aggressive expansion. A key element of this mindset is the desire to maintain full control over financial operations and decision-making power within the company. Entrepreneurs want to ensure that goals and actions are closely aligned with the startup’s financial capabilities. Through regular analysis of budgets, costs, and cash flow, entrepreneurs become more aware of potential financial risks, which makes them more cautious about issues that could threaten the current condition of the company. The dominance of a managerial mindset leads to lower levels of debt (financial leverage). This is due to a reluctance to take on commitments that

involve the risk of losing liquidity or having to surrender some control to external creditors. Entrepreneurs with this mindset are more inclined to critically assess their own skills in managing extreme risk, which further deepens their aversion to situations perceived as uncertain.

The role of financial literacy among entrepreneurs

A key factor modifying the above relationships is financial literacy among entrepreneurs, understood as the ability to understand and apply financial concepts in the decision-making process.

According to sources, a high level of financial literacy mitigates the extreme tendencies resulting from the use of control systems. According to sources, a high level of financial literacy mitigates the extreme tendencies resulting from the use of control systems. Financially competent entrepreneurs are better able to assess the benefits of credit and feel more confident in managing risk, which means they do not avoid debt so rigorously. In the case of non-financial MCS, financial literacy tempers enthusiasm for growth plans. Entrepreneurs with high financial literacy are more likely to analytically assess the costs and risks associated with debt, leading to more prudent financial decisions and less reliance on leverage despite recognizing market opportunities.

Focus on creativity, i.e., non-financial management control systems (non-financial MCS)

Non-financial MCS are strategic tools that help startups understand the market and

stimulate innovation. They provide knowledge that goes beyond numbers, which is key to

increasing the value of the company in the long term.

They focus primarily on:

Non-financial MCS are strategic tools that help startups understand the market and

stimulate innovation. They provide knowledge that goes beyond numbers, which is crucial for

increasing the value of a company in the long term.

They focus primarily on:

- strategic planning – defining the company’s non-financial strategic goals,

- monitoring market trends – understanding trends and demand and tailoring

the product to needs, - product development goals – setting milestones for new projects and

innovations, - sales forecasting – making predictions about demand and future

revenues, - customer relationship management (CRM) systems – monitoring interactions with

customers and identifying their needs.

Their use is positively correlated with the level of debt. These systems support a “creative mindset” focused on rapid growth and business scaling. Information about new market opportunities encourages entrepreneurs to take greater risks and raise additional funds (including debt) to finance expansion.

Promoting a “creative mindset”

The use of non-financial MCS shapes a specific cognitive framework in entrepreneurs,

referred to as a creative mindset. This mindset is characterized by a focus on scaling

the business and proactively seeking new market opportunities. Entrepreneurs, seeing promising growth prospects ahead, are less likely to focus on the company’s current exposure to

risk. Using market feedback and customer data allows entrepreneurs to feel

more confident in their decision-making, as they perceive their actions to be based on

real data rather than just assumptions.

Which mindset should you choose?

The impact of control systems on debt can be compared to driving a car: financial MCSs act like brakes, forcing you to slow down when indicators show danger, while non-financial MCSs act like the gas pedal, encouraging you to accelerate when you see a straight road ahead. In this comparison, financial knowledge is an experienced driver who knows when to ease off the brakes so as not to stand still, and when to take your foot off the gas so as not to fly off the bend. Non-financial MCS allow you to see the distant horizon (new markets) and set a course for your destination. Although the view of the horizon encourages you to step on the gas (take on debt for growth), financial knowledge reminds you to check whether you have enough reserves to survive unforeseen circumstances.

The author of the article is: Marta Piksa, startup ecosystem builder, development project specialist, project manager

source